At least they are wise enough to know it’s time to sell.

Brion Wise Buys Former Cosentino Winery from Vintage Wine Estates

Wine Industry News Article

At least they are wise enough to know it’s time to sell.

From what I’ve been told, they have already sold off some of these assets - or parts of them.

The next week will be interesting to see what deals will happen before the bankruptcy date

Cheers

I think there are/were vineyards on the other side of 101 from Laetitia, don’t know who owned them though. There used to be a scary AF crossing of 101 right at the entrance/exit to Laetitia, there are/were a few places where 101 isn’t entirely controlled access and this was one of them. From looking at Google maps, that small connector between the two sides of the freeway has been removed. It shows the connector on the map but Street View shows it has been removed.

-Al

It’s been removed - as well as those vineyards on the other side of the 101 as best as I can tell . . .

I used that crossing a couple of times including to turn left (north) from the opposite side of the freeway. Not surprised it was removed.

-Al

Yeah, they did get some sales done before the bankruptcy filing. But nothing post-filing can be done without court approval, meaning it should all get done through this auction process.

I don’t know how the law works, so I’m just speculating here. If I were a creditor that wasn’t getting paid, I would be looking long and hard about invalidating the sale of assets pre-bankruptcy filing because those assets may have been the things with the highest value to VWE.

If I were a creditor that wasn’t getting paid, I would be looking long and hard about invalidating the sale of assets pre-bankruptcy filing because those assets may have been the things with the highest value to VWE.

There’s a Committee of Unsecured Creditors whose task is to scrutinize the process, including what happened pre-bankruptcy, up to a point. Generally, transactions that occurred up to 90 days prior to filing are at risk (if with an insider, 1 year). Given that the pre-filing asset sales were done through marketed processes (they hired an investment bank, etc.), it would likely be tough to argue that they weren’t for a market price. (Full disclosure - I’m friends with the investment bankers who worked with VWE on those sales, but what I’m saying here isn’t affected by that relationship)

Thanks Marc. Thankfully, I don’t have any experience with bankruptcies!

Bankrupt California-based vintner Vintage Wine Estates Inc. won court approval to sell five wine brands, including Bar Dog and Cherry Pie, to billionaire Bill Foley’s wine company.

US Bankruptcy Judge Mary Walrath said Tuesday she’d allow the sale of the brands to Foley Family Wines Inc. for $15 million. The buyer owns more than 25 wineries and distilleries, in locations as diverse as New Zealand and Scotland, according to the company’s website.

Here’s the link to the asset purchase agreement:

https://document.epiq11.com/document/getdocumentsbydocket/?docketId=1105942&projectCode=VWE&docketNumber=170&source=DM

Looks like they’re buying Cherry Pie, Bar Dog, Swanson, Cosentino, and Sonoma Coast Vineyards. Includes the real property, intellectual property, and inventory. The schedules have some fun details about the inventory.

Getting Cosentino was genius.

I’m confused.

Wine Industry News Article

I’m guessing Foley bought the brand and inventory and things like the mailing list, Brion bought the property with the winery building.

-Al

I’m guessing Foley bought the brand and inventory and things like the mailing list, Brion bought the property with the winery building

Yes

It’s been removed - as well as those vineyards on the other side of the 101 as best as I can tell . . .

Here was our first dog, Monty, at Laetitia in I think November 2005.

We stopped on our drive at Thanksgiving, probably tasted a few wines, fed the baby, let the dog out.

Way better than a rest stop or fast food place.

Fed the baby? Oh that is funny. That baby is a towering giant monster on the mound at Vandy. I can’t imagine that guy as anything small!

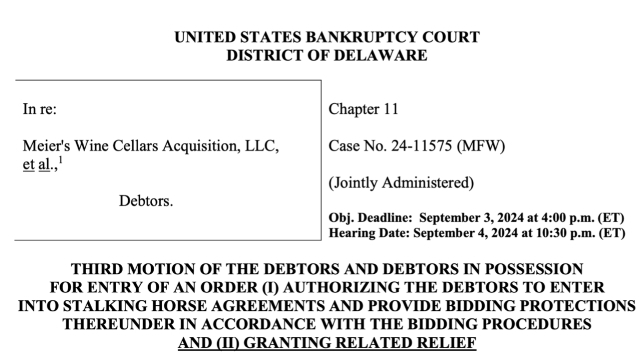

Latest updates about the Vintage saga . . .

Wine Industry News Article

Not bankruptcy, but $1.5 to $2.5B writedown would bankrupt a lot of companies.

Constellation Brands has revised its financial forecast for fiscal year 2025, citing considerable challenges faced by the company’s wine and spirits brands. The revision accounts for a $1.5-$2.5 billion goodwill impairment loss for its wines and...

Est. reading time: 3 minutes

Yep, it’s challenging out there for ‘luxury goods’ that are truly ‘non essential’

Cheers

that is a hell of a haircut