Remember when that was the explanation for the rising price of Bordeaux and Burgundy? We’ll have to find another reason now. It seems that Chinese wine consumption peaked in 2017 and has fallen by more than half since then.

This looks to include cheap imports as well. Not just expensive ones.

I’m sure it does, but, if anything, you’d expect the economic slowdown, and the government’s crackdown on foreign investment and transfers of money outside the country to hit the high end of the market even more than the demand for plonk.

I seem to recall that they have added a huge tariff to Australian imports, which has been a major hit on Australian exports generally. It may be that with far fewer AUS imports and what arrives priced much higher, there isn’t much inexpensive wine to go around. Long way of saying it may well be more at the lower end than the higher. This is all idle speculation obviously.

Not sure about that. Not sure about what is going on in China, but in most places economic downturns tend to impact poorer and more middle class people than the rich. Billionaires tend to remain rich.

There is a simple way of solving this dispute. Assuming such statistics are available, one could check whether the amount of high end European wine imported to China over, say, the last 20 years had risen or fallen.

massive crack down on corruption and also flagrant displays of wealth in china - with no one above the law. Look at Jack Ma as a good example.

Not to say there isnt demand in China for high end wines anymore,b ut I wouldnt be surprised if it was significantly reduced from peak.

Could be. Things like that likely would have a bigger impact on the rich than a recession.

I just came back from a two-week trip to Beijing and Dalian. I travel to China frequently (although I had to stop during Covid for obvious reasons) and I can say much has changed over the last ten years.

I remember back in 2010 it was often that you would go for dinner to a fancy restaurant and you’d see people with nice Bordeaux and Burgundy on their tables. That is all gone. If there is a government official at the dinner he/she will not even dare sit at a table where a recognisable wine is being drunk.

That part is good, I guess. Corruption is way down compared to 10-15 years ago.

The bad part is that there is fear all around. And that is bad for business everywhere in the world. And, of course, wealthy people feel uncomfortable being pointed at because they have a bottle of Chateau Margaux at the table.

I don’t think Chinese demand for nice wine is coming back anytime soon.

I guess there will always be Singapore…

My point, with which I admit I have little proof, is that there is still vast wealth collecting in Asia. And the middle east. Unless suddenly wine is viewed as a common item it will like other form of “art” be collected. And the extra bonus is that unlike a Vermeer or a Van Gough, it is still being made, but not in such large quantities that nearly everyone can afford them . How else can you explain Bizot or Leroy?

There is a durable human appeal to a commodity that says, "I can get it but you can’t. "

Perhaps wine is a better focus for this than rhino horn. That I will never understand.

Of course there’s still vast wealth development and collection. These are developing economies with compound growth rates over years that most western economies will never achieve again tbh. And don’t forget population density too. It’s a whole different game

Thanks for the interesting observations, Juan.

Michael - You’re right about the tariffs on Australian wines – 100%-200+%. I vaguely recall the headlines now, but it hadn’t really registered.

But that was in March 2021, and the steepest decline preceded that.

“Inexpensive wine” in China is an oxymoron.

When I lived in Beijing I remember paying at the retail shops a multiple of up to 3 times what the exact same wine would cost me in Spain. This of course included transportation costs, taxes, commercial margin, etc.

The cheapest wine in relative terms used to be (it still is) that from Chile. Precisely because there is a commercial agreement by which many Chilean products (including wine) get completely exempt from import taxes. This is in exchange for trade bargains like Chile guaranteeing a minimum anual amount of copper and other raw material exports to China.

Australia used to have a similar sort of agreement which China cancelled at the time of the diplomatic conflict. From 2021 to 2026 import duties on Australian wines sold in quantities of below two litres will be as much as 218%. For comparison purposes, I remember Spanish wine duties used to be around 50%.

In other words, do not expect to find a bargain wine anywhere in China. Everytime I travel there I pack in my suitcase three or four bottles which I protect on some of those inflated plastic bags. ![]()

Another article worth reading [1]

https://janeanson.com/market-analysis-bordeaux-in-china

Article [2]

Article [3] - not directly about exports, but more Chinese ownership in Bordeaux is rapidly decreasing

Very interesting, Henry; thank you.

I tried to find it, but I cant atm - I saw another article talking about the relative EP volumes per country and if i recall correctly - it was US, followed by UK, with China below both of those in the list.

I have to say, for me, Americans complaining about Chinese causing wine prices to increase is a little bit hypocritical, but I appreciate that’s not something to get further into on this forum. It is a functionally accurate statement, but that’s more a reflection on wealth and chronological rise to developed economies for the respective countries rather than anything functionally causal imho.

I dont really know where that argument stops, either. It’s recursive all the way down the export markets. Do St Emilion locals complain that the commune of Margaux and city of Bordeaux have developed a taste for their wine, thus increasing demand (and by extension, prices)? Do the Bordeaux locals complain that Paris has now developed a taste for their wine, against increasing prices? The French complain that the English are starting to import their wines? The English complain about the Americans? And also, what’s the future? The Chinese complaining that India, or Nigeria, or Dubai are now snapping up the premium bottles of Bordeaux? I can see the argument for a local complaining that XYZ is now being exported, but an export market complaining just seems a bti strange to me.

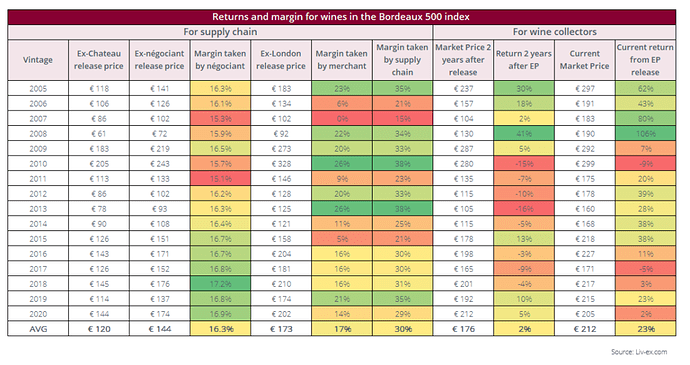

Personally, though I’m happy to be corrected by someone more in the know - I think as Chateau have had more money flow in (whether selling land/equity to investors - Château Petrus stake sold to US-Colombian billionaire - report , through increased en primeur prices, or just exploiting low interest rates in recent years), the pressure for them to sell through en primeur has been significantly reduced. En Primeur, as I understand it, in the 19th century was effectively a financing mechanism to prevent chateau going broke before the wines were bottled and released. That’s no longer a concern for the majority of decent/high end chateau, not when you’re backed by Chanel, LVMH, or similar money. Infact, why would they leave any money on the table at all? That’s why you’re seeing en primeur releases at, effectively, “market price”. As far as the overall increasing market price in the last two decades, clearly some of that was coupled with significantly increased demand (e.g. China), but I dont think that argument really stacks up anymore. This chart from Liv-Ex,

shows really nicely how the Chateau basically want to leave very little margin on the table anymore. If anything, you can probably suggest anything post 2015 has, barring 2019, failed to beat inflation? [Sidenote - a fair question here is why I’m so active with EP related stuff. I think buying well is the crux to EP, and if you buy well, you can significantly “beat” those benchmarks, not that that is my ambition.]

I just wish they’d basically do away with the pretense of En Primeur, and go fully Chateau Latour - we release wines slightly above market price when they’re in their prime. Tough sh!t. We can afford to.

I think I will sit out buying 2022 Bordeaux futures if they are priced higher than normal…

There’s quite a few out already. I’ve personally jumped on the band wagon for Leoville Barton, Langoa Barton, Beychevelle and Carruades. Carmes out this week is something I will likely buy, if its priced sensibly. Cheval Blanc has been priced quite fairly

Many other wines are coming out way too expensive for what they offer, though.

Thanks Henry, this chart is much appreciated. TLDR: Bordeaux 500 from EP is a nightmarishly poor investment. Compare, eg., to the S&P500, on any time frame you choose:

One could argue that you could do better picking stocks, I mean producers. Hard to imagine being both good at that, and wanting to put the capital into a meaningful investment.

Supply chain costs, btw, were super interesting. Something I’ve always been curious about.

Yeah, I found that data really interesting too.

And for sure, Bordeaux 500 is a poor index to be ‘tracking’, I dont even think I could name 500 Bordeaux wines let alone 500 worth buying en primeur.

I’m not a huge believer of stock picking with the stock market, but for wine, absolutely. My 2020 returns are significantly higher than the chart’s 2%, my 2019 is as well.