Those people in the lower income brackets have likely not increased their wine buying budget as a result of any recent income gains.

Multiple reasons we’ve hashed in many threads previously, but ultimately, if you ask me, it’s simply down to the hyperinflationary economy. I don’t care what the overlords say, in my wallet, and in everyone else’s I know, we’re in a depression. I’ve never had a worse financial situation or outlook than I have right now, not even during 2008. This is not a comfortable place to be finding yourself in your early 50’s.

When you don’t feel secure or sure of the future, it’s natural to not spend it on wine.

Unfortunately, I think it will be a blood bath amongst the smaller wineries. I know a lot of them that won’t be left standing by the end of this year and next. My sales are down about 60-70% compared to 2021-2022 (now that might have been an artificial high period during the pandemic, but still). Numbers are numbers.

I’ll soldier on valiantly, but at some point every small business owner has to ask themselves when to pull the plug. I’ve already had that conversation with my wife - last time was yesterday, in fact. We both agree to continue and try to ride it out, but this year it’s 75% reduction in production. And all the expensive Santa Barbara and Napa fruit contracts won’t get renewed for 2024 - its focus on the more affordable Lodi vineyards for this harvest.

I feel for growers - 2024 is going to be even more brutal than it was in 2023 for them. I heard of many wineries who are skipping the 2024 vintage altogether.

Even saying “depression” undermines your entire post. You clearly don’t know what the word means.

There is no definition of depression. Mine is as good as yours.

Adam,

I am really sorry that you are hurting. But I disagree strongly with the tenor of your post. Inflation was very high as the pandemic wound down, it’s higher now than anybody would like, but you clearly do not know ‘hyperinflation’. I am in my late 70s, I remember double digit rates. I was in Argentina with family when the currency collapsed in 2001 (by an amazing stroke of luck, my cousin happened to have a job abroad at the time that paid in dollars; they were fine). Besides Maine, I’m in touch regularly with family and friends in a dozen other states. Most of them are comfortably middle-class but a few live paycheck to paycheck. Nobody has said anything like what you have just posted.

I think inflation is a tangential factor in the difficulties the wine business is facing.

The biggest problem is that the younger generations have far more alternatives than existed for us. When I was beginning to drink, beer was essentially Budweiser and Miller but wine offered a thousand interesting alternatives. About 20 years ago, craft beer started to eat wine’s lunch; a decade ago craft spirits barged in. Plus many young people have cut back severely on all alcohol, or have stopped or never started.

Global warming puts two additional whammys on wine:

Warmer temps = riper grapes = more alcohol, exactly what younger people are not looking for. Yes, there are work-arounds, but this is still the overall picture.

Warmer temps = search for more refreshing beverages = less demand for wine, especially red wines.

I’ve been extremely fortunate. My career coincided with almost half a century of steady increases in wine consumption, not just total but also per-capita in this country. Wine is perceived by many as a glamorous and enjoyable career. Too many people jumped in as the party was winding down. I know that for many the economy doesn’t feel great, but numbers are numbers.

Wage gains yes. The COL increases have more or less eaten all those gains and then some. People with higher incomes aren’t nearly affected as much by cost increases in groceries, energy, and the big one: housing.

And if top earners aren’t seeing wage increases, they are certainly benefiting from asset value gains such and stock and RE, which they tend own at a far higher level.

And they probably are at the age where they are required to start taking retirement distributions.

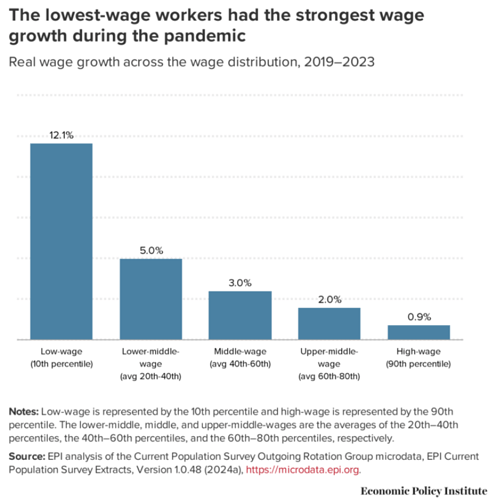

This takes into account inflation:

(I’m not well versed enough in the topic to argue about exactly what inflation is measuring versus what you are calling COL, but against inflation lower income workers have still seen positive wage growth.)

Dan, I disagree, we do have double digit inflation. Not in the doctored CPI rates of course, but in real life. Have you not had all your everyday costs at least increase 20-30% in the last 2 years? Mine have. I’ve not had a 20-30% increase in income, quite the opposite (but my day job is in one of the worst industries, so that’s not a good gauge).

Core inflation excludes food and energy, conveniently. And the housing costs are not captured correctly in CPI with their weird proxy either. Housing prices have increased 40% in last years.

I agree with everything else in your post. And it’s a cornucopia of reasons, for sure, but I want to emphasize that I personally think the whole health aspect, cocktails-are-taking-over, weed etc thing is not the true cause - it’s the underlying economy. People buy wines when they feel they can afford it.

From the highlight in that report:

“Wage rates remain insufficient for individuals and families working to make ends meet. Nowhere can a worker at the 10th percentile of the wage distribution earn enough to meet a basic family budget.”

positive growth, but insufficient growth

It’s very industry dependent. Healthcare has had the perfect storm of losing a lot of people to death/retirement and greatly increased demand. It’s a fantastic job market for everyone, but everyone is also overworked and constantly exhausted. Annual wages especially at the tech and nurse level has dramatically increased, though.

I’m not dismissing the problem, but is that not shifting the goalposts a little bit? The wage growth of of all lower wage categories outpaced inflation significantly more than that of high wage categories, which is what I thought was being disputed.

I never disputed that lower wages weren’t increasing at a higher rate, just that the gains aren’t really meaningful enough.

I also don’t think wages are a good indicator at the top end of the spectrum, given the stock market and housing prices.

Idk what the answer is to the California winery situation is. I do know that for what it’s worth, this community has been able to help out to some degree. @ToddFrench and @brigcampbell did a pandemic relief event during the pandemic that I do think helped wineries and perhaps WB could consider other events if this is a particularly bad year, obviously not a long term solution though, but could be worth discussing if it could help?

1932 depression: “I can’t afford bread.”

2024 depression: “I can’t afford Tignanello.”

This board and its members have been fantastic. That’s why I’m even in business, still.

That’s the only point I was arguing against. I thought you were disputing that the lower income wages hadn’t outpaced inflation. (Which is why I also qualified and said I don’t know enough about the difference in whatever we call inflation versus whatever we call COL. In my head, they mean roughly the same thing.)

In any case, I believe we can agree that in the lower wage groups, even if they have made gains, the gains are not enough to meet basic needs.

The generally accepted quip is;

A recession is when your neighbor loses his job

A depression is when you lose yours

You still gotta job???

Another factor in this specific case may be that Tignanello and the Super Tuscans have lost a lot of their cachet.