1996 Leoville las Cases is a great wine. When you look at some of these wines, think about Ducru Beaucaillou and Montrose. I like them better in general than Lynch Bages, Pichon Baron and Leoville Poyferre and consider them at least equal to if not better than Pichon Lalande. Compare TN: Chateau Montrose with Mr. Herve Berland - WINE TALK - WineBerserkers and Chateau Pichon Baron 1989-2010 and Krug 2000 - WINE TALK - WineBerserkers

I would recommend slowing down some of your purchases and buying some older bottles to start. Scratch the itch via auction.

Also, morrell has lower minimum orders for futures.

All

I had convinced myself that I would go slow but then I also convinced myself that I should think of it as a small investment and allocate a portion of my assets to it ![]()

I ended up pulling the trigger on 6 of VCC 15 and 12 of Calon Segur 16 ![]()

I am planning to buy in the US as well as though my account at Berry Bros. It feels it’s easier to trade in the future using UK platforms should I change my mind. They have their own storage warehouses with low fees and commissions are low (BBR charges 10%). Moreover easier to buy from other users who have bought sine en primeur from BBR and have stored it with them.

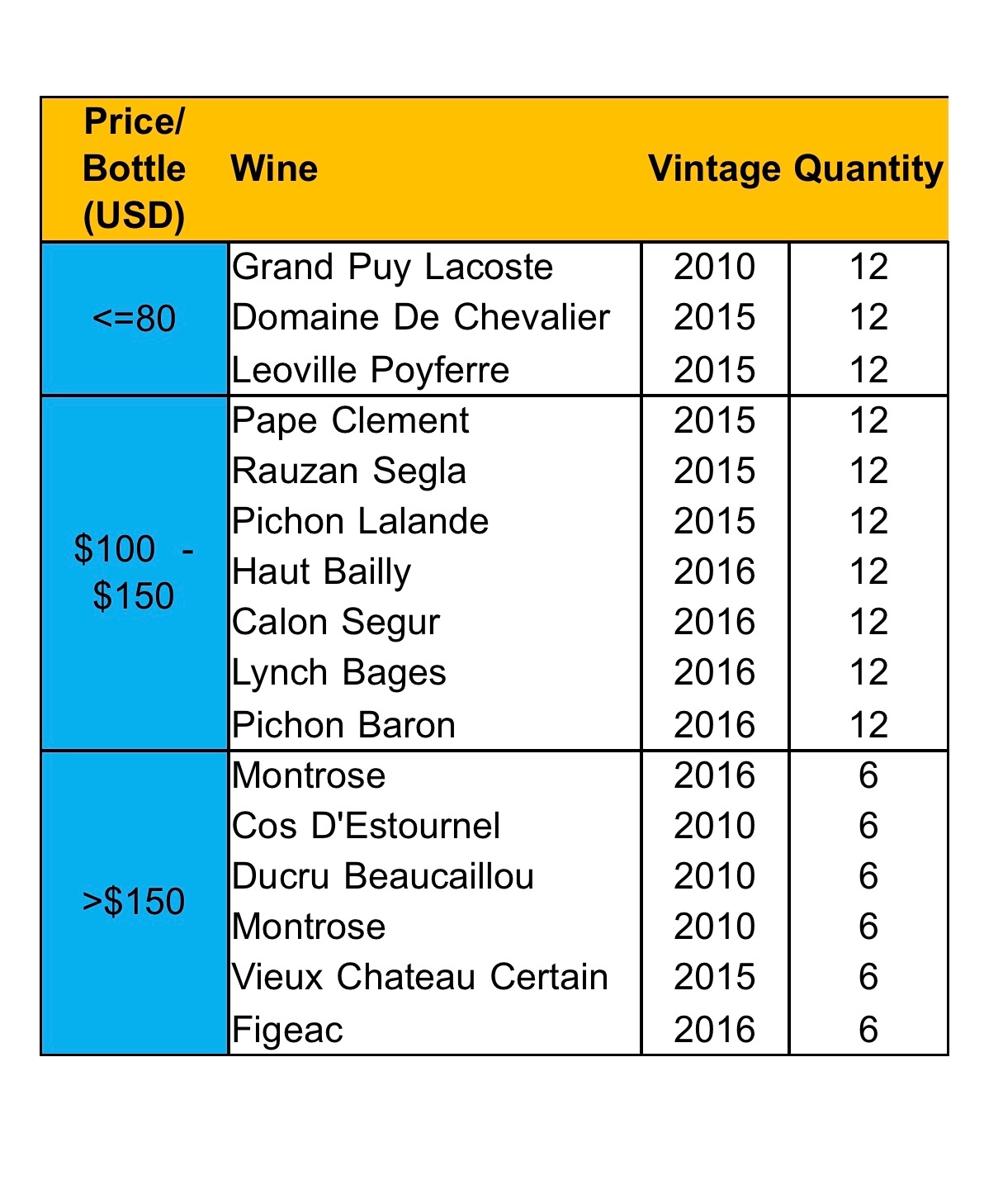

I am not planning to buy all of this at once but sort of the broad list I created.

Any feedback would be welcome, in particular:

- For each price point if you have any other suggestion

- Any suggestions on vintage swap

156 bottles of Bordeaux, none of which will be in a drinking window for quite a while. It’s a lovely set to stash. I might consider flipping some cases to half cases, then reallocating purchases to 1990-2000 Bordeaux and seeing how you enjoy those so you can get a bit of a bead on how they’ll age (taking into account that many producers have shifted style and weight considerably since those years, even if you’ve got some more traditional names on your list).

![]()

To each his own, of course, but would think long and hard about this first. There are many illiquid alternative asset classes with better returns and less of a discount when you want to sell. Plus, I would want to enjoy my VCC when it reaches its prime rather than worry about any built in appreciation. Of course, if you end up with too much wine and otherwise have enough money, then your heirs are just receiving some inheritance via aged wine.

For your goals, why not do magnums over 750s? Further, you can take on a 375 for yourself to check in 10YRs and figure out if you want to keep or trade out of the wine.

Have signed up for the mailing lists at MacDonald, Cirq, SQN, Myriad, Saxum, Dunn, Outpost, Rivers Marie, Scarecrow & Philips Togni. By the time I get the opportunity to buy some of these wines, I should have a better idea of which of these I might like

Those are wildly different wines and styles. I’d pass on most and I own others.

But it’s still nuts to try going out and building a cellar in a few months. You really should stop and try a lot of different wines at different ages first.

Dinesh

I started building about 7 years ago, my tastes have changed many times and there are wines i once thought were essential that now are relegated to Pizza wines.I echo others that suggest you get out and drink more before buying cases of hard tannic unfruity Bdx

Otherwise known as regal, complex, long-lived, delicious wines.

And that, Dinesh, is the point.

All

I acknowledge there isn’t a lot of merit in what I am thinking of doing. I just wanted to share the thought process so that I don’t come across as lunatic

- I thought of this investment as almost my gift to myself for when I turn 60

- I separately expect to start building a cellar for wines I will consume right away and over the next 5-10 years

- As I do that I very much might realise that I do or like the gift I have purchased for my retirement or that I like something better. That’s why I am thinking that I might not ship the wine to the US for the next 10 years. Worst outcome is price remains flat and I have some money on on storage, insurance and sales commission.

If you’re buying multiple cases of 2015 and 2016 Bordeaux and you’re now about age 60 (not sure, your post could be read several ways), I hope both your parents lived well into their 90s and you got their longevity genes.

Haha - 38.

Then you are starting at the right time, Dinesh! I began at 29. Made my share of mistakes along the way but mostly have been enjoying the results.

You never know how your palate preferences may develop so heavily buying one region at the start has some risk. OTOH, buying young blue chip Bordeaux mitigates that risk somewhat because it’s likely you can recoup most or all of your investment if you decide they’re not to your liking when they (and you!) hit their peak.

Thanks David. And that’s why as a hedge I have also decided to store a lot of them in the UK. It felt like it’s much easier to buy, store and sell all under one roof. On top of that the commissions are much lower (10%).