Who thinks this?

The logic upthread was perception of softer market = bargain hunters come out of the woodwork = more buyers = decently strong hammers. I follow the logic, but I don’t know that I agree. Bargain hunters aren’t going to bid lots up to strong hammers — just pick off bargains that might’ve otherwise passed. so perhaps there’s some insurance against lots going unsold, but that hardly makes for a “great time to sell,” IMO.

Yep - agree.

Insurance against lots going unsold sounds about right. Not the best time to sell, but certainly not the worst either.

Hey Jim,

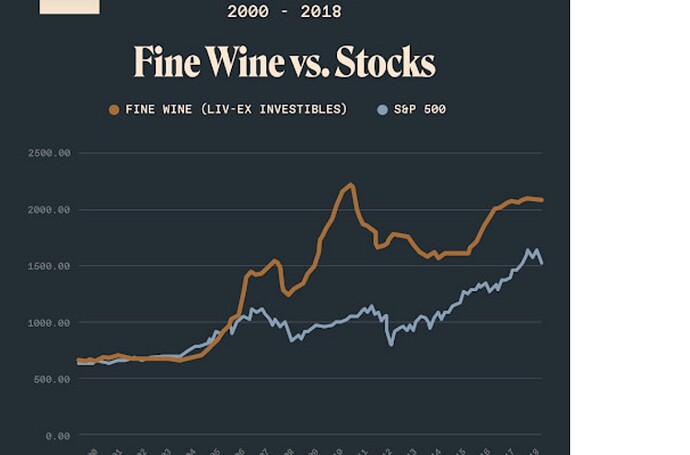

It’s been a while. The market is soft; i.e., most top-end Burgundies are down 20 to 25% via auction. It’s strange because wine prices usually have a pretty good correlation to the US stock market. Which is broken for the first time since the late 80s.

Its kinda funny, because I think the argument that wine is uncorrelated to the stock market is absolute nonsense, but so is the argument that its strongly correlated.

For the first time arguably ever, wine exists as an investment asset class in a high interest environment. It’s not an attractive investment in that framework.

I think it will struggle as an investment class until interest rates come down SIGNIFICANTLY.

Producers need to react accordingly or they’ll risk losing release demand for their wines, like Bordeaux en primeur 2021/22/23. Many of those wines now available at discounts to significant discounts to their original releases.

I just gogoled. I have been following the markets since the late 80s and this is the first time that the stock market is at the top when the wine market is down between 20 to 30%.

Not to mention the issue of tariffs … there was in the past, and I assume there is now too, a difference in position on wine tariffs. Wouldn’t be too exciting to see those come back. … and, while we’re on the topic, we all saw prices INCREASE when tariffs were imposed, but how many retailers actually LOWERED prices when the tariffs were lifted …? ![]()

Yes, there were some articles about tariffs coming back, and even wholesalers buying just in case. But then I think that portion of the debate is verboten, as we stray into politics.

Hi Jim

Steve Adams just sold Jeff Bell’s wine cellar so you may want to email him for some advice.

Hope all is well with you and Rasha

mark

Hey Mark — wow, long time. Hope you’re well. I’ll have to reach out.

I stepped away from the thread I created here because things got busy. But, to answer some questions — I have a mix of 2000, 2001, 2003, 2005 BDX and Barolo/Barbarescos from 2013/2016 — along with some older Northern Rhônes, 2001, 2002 Germans (which I expect are nearly worthless despite being consistently awesome), and a a mish mash of misc stuff.

Pricing softened as rates/oppty cost increased, will

Interesting to see what happens as this changes

This does not correlate to a softer market.

Think about this, if a sale is $5 million low estimate, and you contribute only $25K to the sale, how much value (not literally speaking) are you adding to the actual sale? There is probably 2-3 consignors that represent at least 50% of the sale, if not more. The auction house is using the large collections to pave the way for the smaller ones.

Without getting into all the mechanics of how a wine auction works, there is a fixed cost of doing business by consignor. So raising the bar from $10K to $25K is going to be in response to cost analysis too. All of the auction houses are tightening up where they can (and in some cases, adding fees or raising fees).

BTW, 2008 Cristal was not $1000 a magnum on release either. No where close.

Hi Jim,

We are starting to see the wine market heat up a bit. The Acker and Zachys live sales in January did quite well, and the Zachys sale yesterday had almost no bargains (with quite a few very high prices). The Acker sale next week will be another indicator, and if we see it continue through the spring, I think we can safely say that the market is coming back.

I think you should probably wait out the market a bit still. Things like Bordeaux tend to rise a bit later than Burgundy. The Italian and Rhone wines will do well now, but you are much better off putting it all together as one lot.

I would consider drinking the German stuff though. Not knowing the full details of the list, and based on what I’ve recently priced out for clients, I would say that you might get $60 a bottle on the high end in return, and if you are enjoying them that much, there’s little reason to sell them.

My armchair analysis just from looking at the online, non super-high-end market is that we probably bottomed out 3-6 months ago. Now everyone has heard the market is soft and has gone looking for deals, making it not quite as soft as it was just a short time ago.

I think we have to differentiate between the Burgundy market and everything else. Top Burgundies saw increases to levels which were unsustainable. It seemed that wine lovers and investors were all chasing the top wines, and produced its own little bubble. It may not have burst, and although Zachys auction showed low to mid estimate sales, I am waiting to see what happens at Acker, with all the frenzy of La Paulee to see the strength or otherwise of the market.

Bordeaux prices seem much more stable, and I was surprised to see relatively weak vintages doing so well. Part of it represents my own prejudices, based I literally have no bottles of 2003, and 2013 in my cellar, yet it seemed that they commanded pretty good prices yesterday. In many instances they were case lots, sometimes multiple case lots, so it wasn’t just a question of people picking out stray bottles, but purchases from people who were planning either to drink a lot of these wines or expected to sell them for a profit.

I still see that segment as full of deals, as pricing of those wines comes up last usually.

The high end of the market still had really good deals in November and December, and looking in 2024, those deals are fading quickly.

The idea that anyone would still buy high end Burgundy (or really anything, but you mentioned Burgundy specifically) from Acker absolutely baffles me. Perhaps “the market” knows something I don’t, but the bottom line is, there’s just flat out other places to buy this stuff. Nothing they’re selling won’t be available from another outlet in the next 3-6 months.

I would beg to differ.

The La Paulee catalog for the first 1121 lots is full of very real wines that span more than a century, and are in remarkable condition.

And if they do appear at another outlet in the future, they will undoubtedly have come from this auction.

Typically the La Paulee auction is one of the most interesting. As Ian said, many of the wines are unique and although it has more than its fair share of Rousseau, DRC, Leroy etc, I love the older offerings. They are no longer the bargains they used to be, but for many, it is one of the few opportunities to buy pre and immediate post war Burgundy.